The W-4 form, officially titled “Employee’s Withholding Certificate,” is a form used in the United States that employees fill out to tell their employers how much federal income tax to withhold from their paychecks. The form is provided by the Internal Revenue Service (IRS).

Purpose of Form W-4

Whenever you start a new job or switch positions, you’ll need to fill out Form W-4. This form tells your employer how much tax to deduct based on your expected earnings and other personal details. It’s vital to be accurate to avoid

- Overpaying and lending money to the government.

- Underpaying and facing a large tax bill with possible penalties later.

Recent changes to Form W-4

The Form W-4 underwent significant changes in 2020. These changes were implemented to make the process of specifying withholding more accurate and user-friendly, and they reflect adjustments made in response to the Tax Cuts and Jobs Act of 2017. Here are some of the key changes that were introduced:

- Removal of allowances. Prior versions of the W-4 used a system of “allowances” tied to the personal exemption to help determine withholding amounts. Since the Tax Cuts and Jobs Act eliminated personal exemptions, the 2020 W-4 no longer uses this allowances system.

- Introduction of a five-step process. The redesigned W-4 introduced a five-step process for indicating how much tax should be withheld. Only Steps 1 and 5 (entering personal information and signing the form) are mandatory. The other steps are optional, but providing this additional information will result in more accurate withholding.

- Multiple jobs and working spouses. The new W-4 includes a dedicated section for indicating if a person holds more than one job or if they have a working spouse. This adjustment is to ensure that the right amount of tax is withheld when there’s more than one income source in a household.

- Claiming dependents. The form has a section where taxpayers can factor in the tax credits they expect to claim for dependents.

- Other adjustments and extra withholding. The redesigned form allows for other income (not from jobs), deductions other than the standard deduction, and any extra withholding an employee wants.

- New publication and worksheet. The IRS introduced Publication 15-T, which includes worksheets that employers can use alongside the new W-4 to calculate withholding. This was necessary due to the significant changes in the form’s design.

- Existing employees and the new form. Employees who had already submitted a W-4 in a previous year were not required to submit a new W-4. Employers continued to calculate withholding based on the previously submitted form. However, any new hires or employees who wanted to make adjustments after 2019 were required to use the new form.

Frequency of submission

While the IRS suggests updating Form W-4 annually, it’s not mandatory unless there are significant changes in your life, such as a new job, marriage, divorce, or the birth of a child.

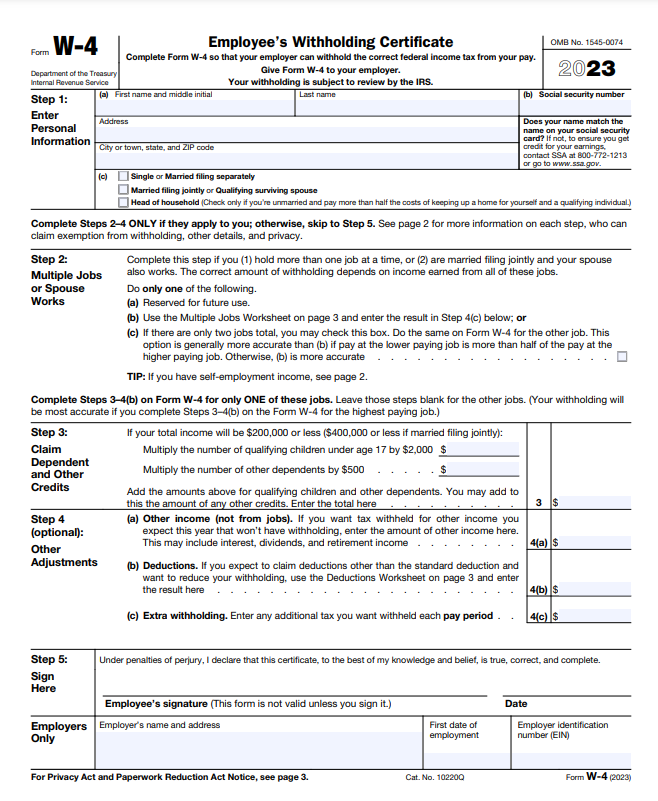

How to complete form W-4?

Step 1 → Provide personal details like your name, address, social security number, and marital status.

Step 2 → Mention if you have multiple jobs or if you and your spouse are both employed.

Step 3 → Parents can indicate if they qualify for child tax credits.

Step 4 → Detail any extra deductions or additional tax to be withheld.

Step 5 → Review, sign, and date the form.

Notes:

- New employees filling out the W-4 for the first time must complete Steps 1 and 5 at a minimum.

- Current employees updating their W-4 can fill out only the sections requiring updates. For instance, if you simply want to adjust the additional withholding amount, you can fill out Steps 1 and 4(c), and then sign the form.

- If you’re uncertain about any aspect of the form, consider using the IRS’s Tax Withholding Estimator tool. It provides a detailed guide through each section based on your individual financial situation.

Always consult with a tax professional if you’re unsure about how to complete the form, especially if you have complex financial situations such as multiple sources of income, large amounts of non-wage income, or significant deductions.

What’s the difference between W-4 and W-2 forms?

Form W-2, sent annually by employers to both the employee and IRS, details the employee’s total wages and deducted taxes. The W-4 is retained by the employer, while the W-2 is submitted to the IRS.

In other words, the W-4 is a tool for employees to communicate their tax situation to employers for accurate tax withholding, while the W-2 is an annual summary of wages earned and taxes withheld, which is crucial for tax filing.

Miscellaneous

Using technology for accuracy. The IRS recommends using their online Tax Withholding Estimator for precise withholding calculations.

Processing time for new W-4. New forms typically impact your next paycheck, but existing employees may need to wait up to 30 days after submitting an updated form.

If no W-4 is provided. If an employee doesn’t provide a W-4, employers will classify them as a single filer with no allowances.

Accessing form W-4. The 2023 version of Form W-4 is available on the IRS website. Always use the most recent form available.

Requirement to update in 2023. Employees aren’t required to submit a new form in 2023 unless they have changes to report. Employers can request an update, but if the employee declines, the last submitted form will be used for tax calculations.

« Back to Glossary Index