The world has been heading to digitalization in all spheres of life for decades and the pandemic boosted this trend dramatically. No wonder that in 2021, (update for 2022 about cash app) a credit card to debit card transfer app is considered a good investment and business CEOs start to pay more attention to the niche of cashless payments. Even though the banking industry transforms at a great pace, MWDN experts track the trends. Let’s find out how to build an app like Cash App and how much time and money this might take you.

How do you create a cash app?

Creating an app to send money online is a good idea for a startup as even though there are plenty of P2P payment systems, the market is still unsaturated. However, to be successful in this niche, you should consider the following elements of app development.

Discovery stage

Be unique. Think of your target audience and create specific features that will boost its interest. You can opt for the regional market or implement collaborations (like Cash App did with Starbucks).

Think of the monetization. If you wonder how does Cash App work, you will see that their main profit comes from transaction fees. However, you can also opt for paid registration or advertisements.

Secure networks for payments online

Guarantee security. When clients decide to send money online on a bank account, they expect that their funds will come to the recipient and their financial data will stay secure. Implement information encryption, account security, login codes, and push notifications in case of suspicious activity with your client’s cash app card. Try to get the PCI DSS certificate. It was implemented in 2004 and is supported by Visa, MasterCard, Discover, and other market leaders.

Development stage

Create an MVP. Test a payment app with core features first and don’t risk your investments. You can always add functionality when you’re sure that your startup will conquer the world of P2P payments.

Use third-party APIs. This is a common practice that allows you to save money on developing core and additional features.

Deployment stage

Any P2P payment application should implement massive testing to guarantee its clients’ security. At this stage, think of customer support services that will make your application more trustworthy.

Are there only person-to-person payments?

Of course not. For example, Cash App also assists with C2B payments. Moreover, they also have a Cash App Investing service that allows clients to buy a share of any company at the stock market and trade Bitcoins. Your business model and core features of your application are up to you, however, creating a P2P application is easier, faster, and cheaper than founding a top-to-bottom banking platform.

Best peer-to-peer payment samples: Paypal/Venmo, Square Cash/Cash App

Venmo was founded in 2013 and soon after it became a PayPal subsidiary. In 2019 it had 40 million clients. How does Venmo work? Some basic features there are free, such as creating a Venmo account, sending, and requesting money. Venmo app has focused on UX, making it easy to use and highly functional. Link an app to your debit card, and you are ready to send money online or make other transactions with your funds.

Another successful cashless bank app is Cash App, also known as Square Cash. With its help, customers can transfer money knowing their peer’s card number, phone number, or email. Afterward, money can be withdrawn through ATM via a special visa card called world Cash Card. In 2020, it had 24 million active users per month and its popularity doesn’t fade.

How do I start a business like Cash App?

First of all, you can select several business models, which would suit your needs. These are the solutions you can choose for your peer-to-peer payment app:

- Bank-centric solutions

- Standalone financial services

- Social, messaging, or web platforms

- Mobile OS/device manufacturers

How to make a new cash app that will stand apart? Analyze your target audience and meet its needs. For example, Venmo and Cash App are convenient to make regular payments (to a landlord, for example), split the bill, or send money on request.

What does it take to create a cash app?

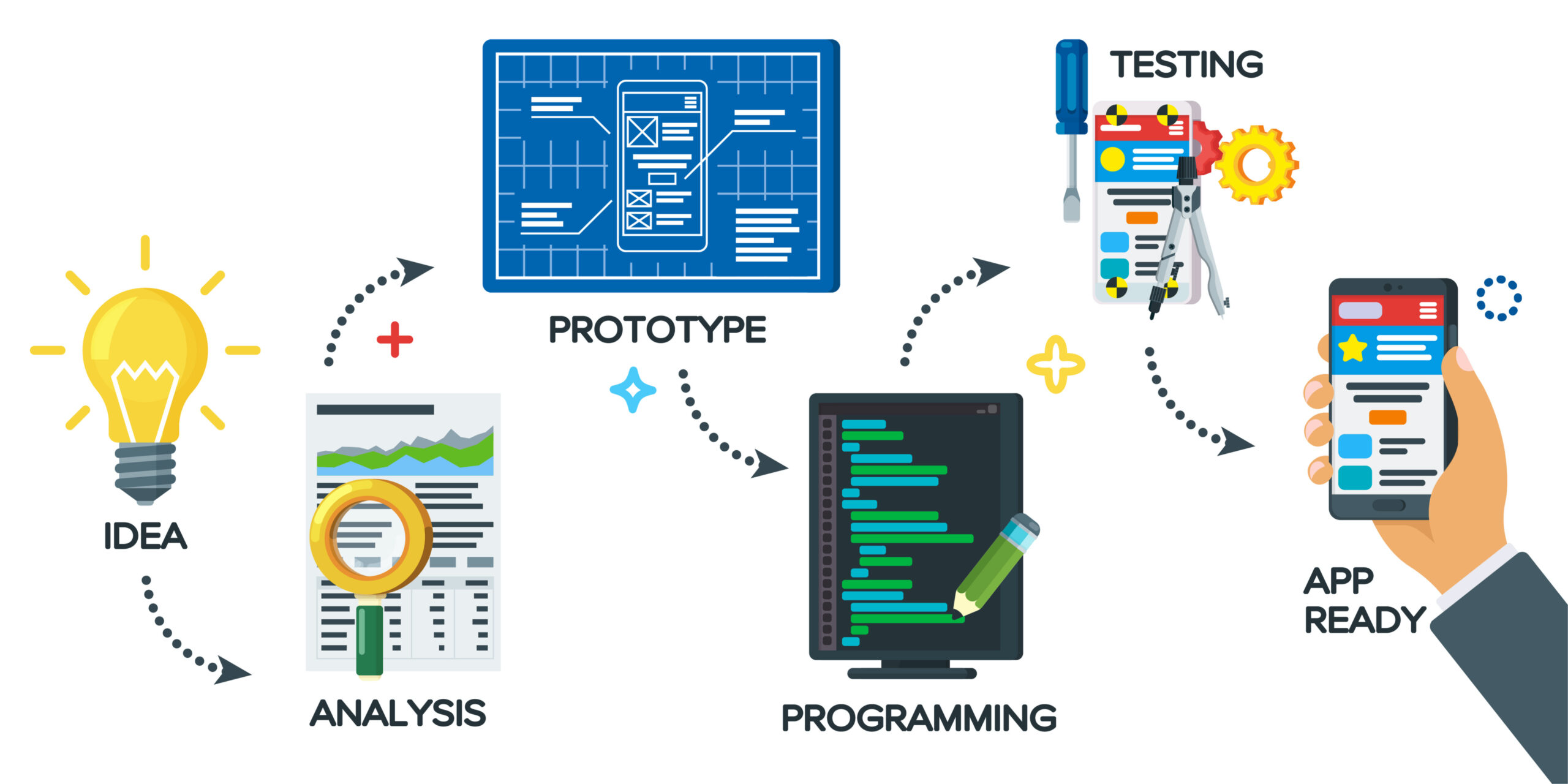

There are several stages in every mobile development process. First, an app development team analyzes your requirements and estimates the time it will need. Then they build a roadmap to have a clear view of the current and future steps and choose the necessary technology stack for back-end and front-end development.

Design is another integral part of development. It can take a while as your app has to be as user-friendly as possible. Once it is complete, developers start building your app. Every function is checked by QA engineers. Quality assurance specialists also analyze the UX and cash app security. When your app is deployed, you can maintain a team to resolve issues that might occur in the future.

How much does it cost to make a cash app with Ukrainian developers?

The final price of your app will always depend on the functionality you need. On average, outstaffing companies charge $40 to $60 per hour of their software engineers’ work. Along with developers, you will need designers and QA specialists. As a rule, a peer-to-peer payment app MVP development takes from three to nine months. This means that in total you might spend from $25,000 to $200,000 for an app.

If you want to calculate the exact price of your P2P application, feel free to contact our managers. MWDN has experience in creating financial applications and is always here for you to transform your startup idea into a successful business.

Content