FinTech is a combination of two words: “Finance” and “Technology.” It refers to software, apps, and other technologies that improve and automate financial services for individuals and businesses. Think of it as using technology to make money management easier and more efficient.

FinTech examples

Fintech encompasses a wide range of applications and services that are reshaping the financial industry. Here are several examples to make the notion clearer:

Payment systems

- Mobile payments. Using smartphones for transactions (e.g., Apple Pay, Google Pay).

- Peer-to-peer payments. Transferring money between individuals (e.g., Venmo, Zelle).

- Cryptocurrencies. Digital currencies operating on blockchain technology (e.g., Bitcoin, Ethereum).

Lending and borrowing

- Crowdfunding. Raising funds from a large number of people (e.g., Kickstarter, Indiegogo).

- Peer-to-peer lending. Connecting borrowers and lenders directly (e.g., Prosper, LendingClub).

- Digital wallets. Storing and managing digital payments (e.g., PayPal, Alipay).

Investment and wealth management

- Robo-advisors. Automated investment platforms (e.g., Betterment, Wealthfront).

- Crowdfunding platforms. Investing in startups and projects (e.g., Kickstarter, Indiegogo).

- Cryptocurrency exchanges. Platforms for trading cryptocurrencies (e.g., Coinbase, Binance).

Financial management

- Personal finance apps. Budgeting, saving, and tracking expenses (e.g., Mint, YNAB).

- InsurTech. Using technology to improve insurance services (e.g., Lemonade, Coverage).

FinTech is one of our favorite domains! MWDN has been hiring specialists for FinTech projects for many years. Today, our portfolio includes some well-known cases like VatBox, an app to manage your taxes, and Charge, a popular wallet with benefits.

How does a FinTech app work?

Let’s get to know how FinTech works with the example of a banking app. A banking app typically functions by connecting to a user’s bank account through secure APIs. This allows the app to access account information, initiate transactions, and provide various financial services.

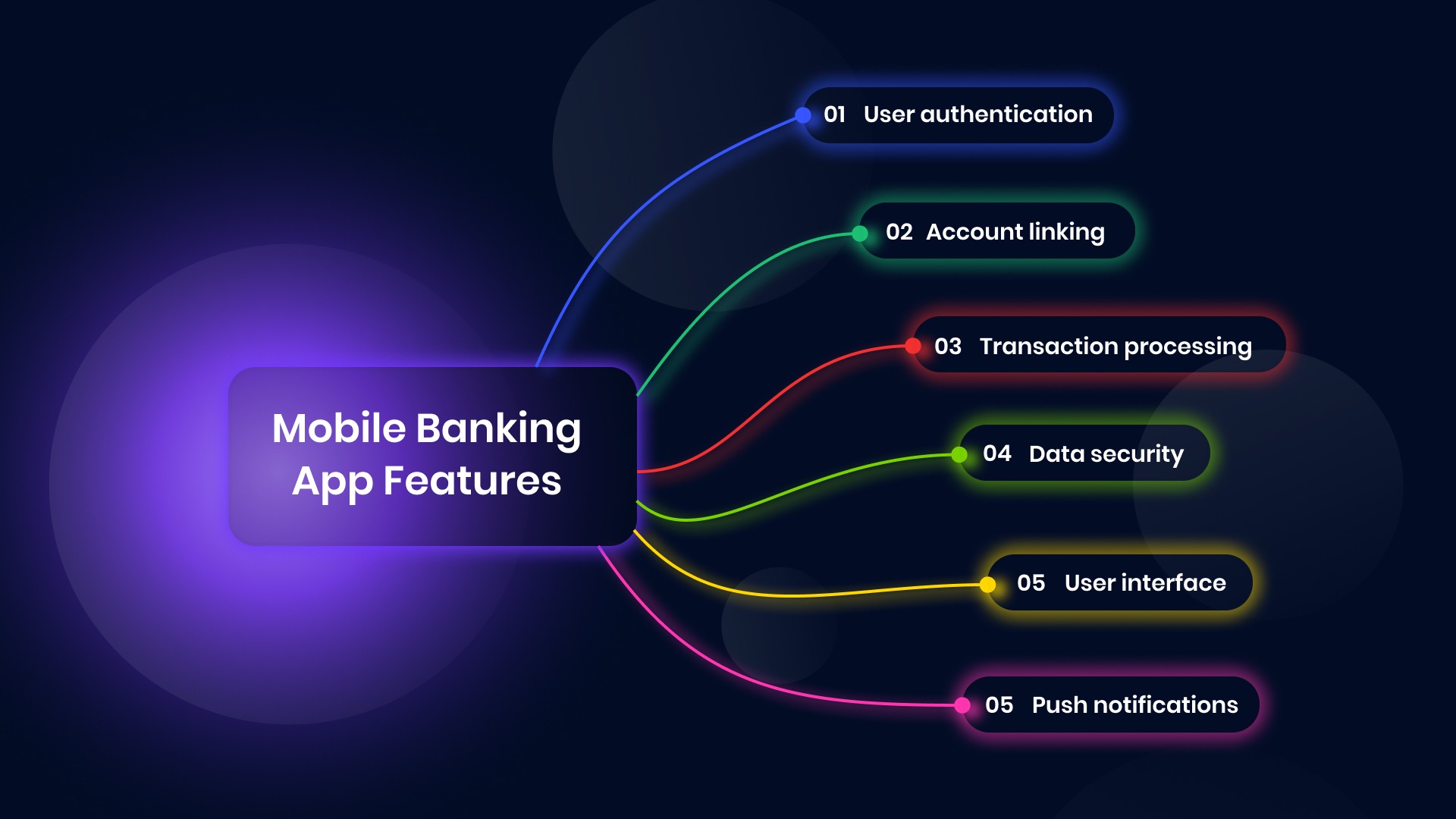

These are some of the key components and processes involved in the work of a FinTech banking app:

- User authentication. Strong security measures are essential to protect user data. This often involves multi-factor authentication (MFA) like fingerprint or facial recognition.

- Account linking. Users connect their bank accounts to the app using secure APIs provided by financial institutions.

- Transaction processing. The app facilitates fund transfers, bill payments, and other transactions through secure connections to the user’s bank.

- Data security. Robust encryption and security protocols are implemented to protect sensitive financial data.

- User interface. A user-friendly interface allows customers to easily navigate and perform various financial tasks.

- Push notifications. Real-time alerts for transactions, low balances, or other important notifications.

Additional features may include budgeting tools, investment options, and other financial management features.

What technologies are used in FinTech projects?

Fintech is a technology-driven industry that leverages various tools and platforms. Its core technologies include blockchain, which underpins cryptocurrencies and provides secure, transparent, and decentralized transaction recording; AI and ML, which are used for fraud detection, risk assessment, algorithmic trading, and personalized financial advice; cloud computing, which provides scalable infrastructure for fintech applications; big data to processes vast amounts of financial data for insights and predictions, and cybersecurity to protects sensitive financial information from cyber threats.

Among the most popular programming languages and frameworks developers use to create FinTech apps are Python, which is popular for data analysis, machine learning, and backend development, Java, robust for enterprise-grade applications and financial systems, JavaScript, which is essential for front-end development and web applications, C#, which is used in various fintech applications, especially in the Microsoft ecosystem, and Ruby on Rails, known for rapid development and web applications.

Other technologies might include biometrics for secure authentication (fingerprint, facial recognition), API integration to connect different financial systems and services, and data analytics for extracting insights from financial data. The choice of technologies depends on the specific fintech product or service being developed.

What kind of specialists do you need for a FinTech project?

Building a successful fintech product requires a diverse team of specialists. You will need both technical and business specialists. Among them:

- Software engineers to develop the core functionalities of the fintech application.

- Data scientists to analyze financial data to extract insights and build predictive models.

- Blockchain developers for projects involving cryptocurrencies or distributed ledger technology.

- Security experts to ensure the protection of sensitive financial data.

- UI/UX designers to create user-friendly interfaces.

- Financial analysts to understand financial markets and products.

- Product managers to define product vision and roadmap.

- Compliance officers to ensure adherence to financial regulations.

- Risk managers to assess and mitigate financial risks.

« Back to Glossary Index