A W-2 employee is someone employed by a US company or organization. Each year, they get a W-2 form to show their income and the taxes taken out.

W-2 employees are not contractors or freelancers. They have rights and benefits in the US, like health coverage, paid breaks, job loss benefits, and insurance for workplace injuries. This concept is for the US and might not match rules in other countries.

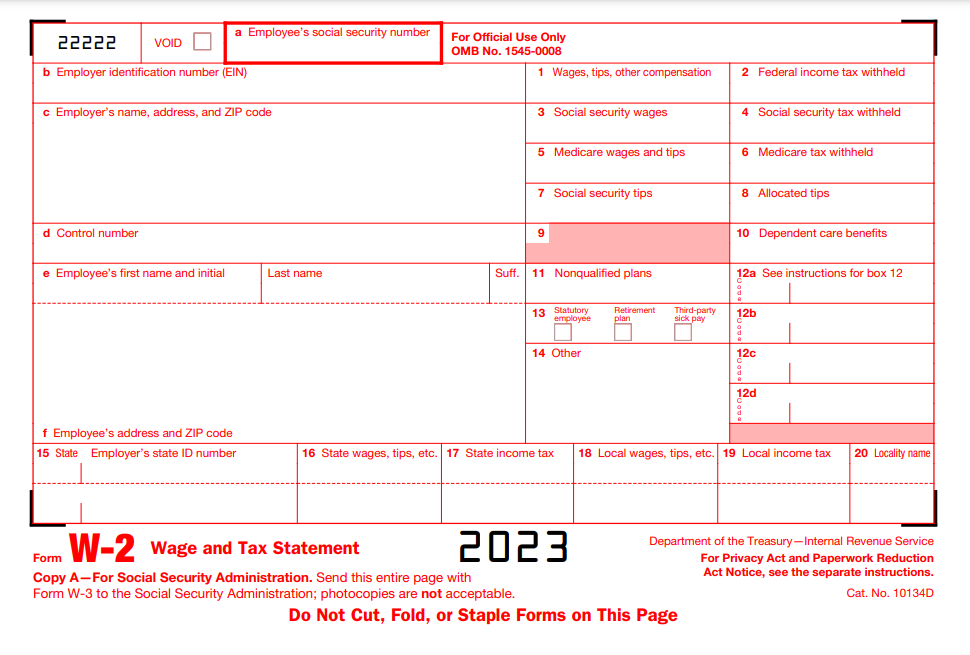

Understanding the W-2 tax form

Form W-2 states how much your job paid you and the taxes its accountant department took out. Every worker gets a W-2 from their employer, but contractors get a different form (Form 1099-NEC). Employees use the W-2 form when doing their taxes with the IRS (Internal Revenue Service).

Benefits for W-2 employees

W-2 worker benefits are the additional perks and extras, aside from direct labor pay, that companies offer their employees. These benefits include:

- Medicare and social services taxes (FICA taxes)

- Insurance for job injuries

- Job loss benefits

- Health plans, sometimes special ones based on company size

- Time off under the Family and Medical Leave Act (FMLA)

- Disability coverage

- Retirement savings options

Getting a W-2 form

As an employee, you can expect that your employer gives you a W-2 form every year by January 31st. If you can’t get it from them, the IRS can help. The Internal Revenue Service gives you a copy of the form if you haven’t received one.

Copies of the W-2 form

You, your employer, and the IRS get copies of your W-2.

- Copy A – should be sent to the Social Security Office by tax day.

- Copy B – should be saved until you use it for your taxes.

- Copy C – should be stored by you for at least three years.

- Copy D – should be kept by your employer.

- Copy 1 – should be sent by the employer to local tax offices if needed.

- Copy 2 – should be kept by you for local tax offices if needed.

If you have more than one job, you get a W-2 from each employer. Using multiple W-2s for taxes is okay. At the same time, it’s rare to get many W-2s from one employer. The latter can happen in some particular cases, for example, if the company was sold.

For Non-US Workers

The W-2 is for US taxes. If you’re from another country but work for a US company, you might get Form 1042-S which you need to include in your taxes.

If you work in another country for a US company, you usually pay taxes to your local government. However, in the US company might still take out US taxes. Check for agreements between the US and your country to avoid double taxation.