When you think of outsourcing IT services and software development, there are several regions that come to mind first. India, for sure; Vietnam, could be; Argentina, especially if you’re from Canada or the USA; Ukraine, if your business is in Israel. But there is also one country that deserves to be mentioned among the top IT outsourcing hubs.

Recently, Poland has become a hot spot for outstaffing and outsourcing services, delivering excellent web and mobile development services for the world’s leading enterprises. Google, Amazon, Microsoft, Oracle, and other tech giants build R&D centers actively hiring in Poland because of its favorable business climate and a vast resource of tech talent. Delivering the most praised services, the rate of Polish software developers is more affordable than in other European countries. In addition, in 2022, Poland had an intriguing synergy with Ukraine (the other top outsourcing destination) that may influence the Polish IT market.

If you’re about to hire software developers in Poland, you should have the latest insights into this market. Here we have some answers regarding pretty much everything you should know about the IT market and hiring in Poland in 2023.

Global IT Outsourcing Market On the Cusp of 2023

Outsource Market Dynamic

The last few years create unseen challenges for the global economy, making entrepreneurs look for safer and more economical ways of doing business. According to Global Economic Outlook, the global economy is expected to develop at a slower rate from 6.0 percent in 2021 to 3.2 percent in 2022 and 2.7 percent in 2023.

Global challenges such as the COVID-19 pandemic and the war in Ukraine affected the global economy. The complex business environment in the world is a challenge that prevents technology companies from growing. That is why the use and application of outsourcing and shared services (OSS) in the world have become an effective business multi-billion dollar approach.

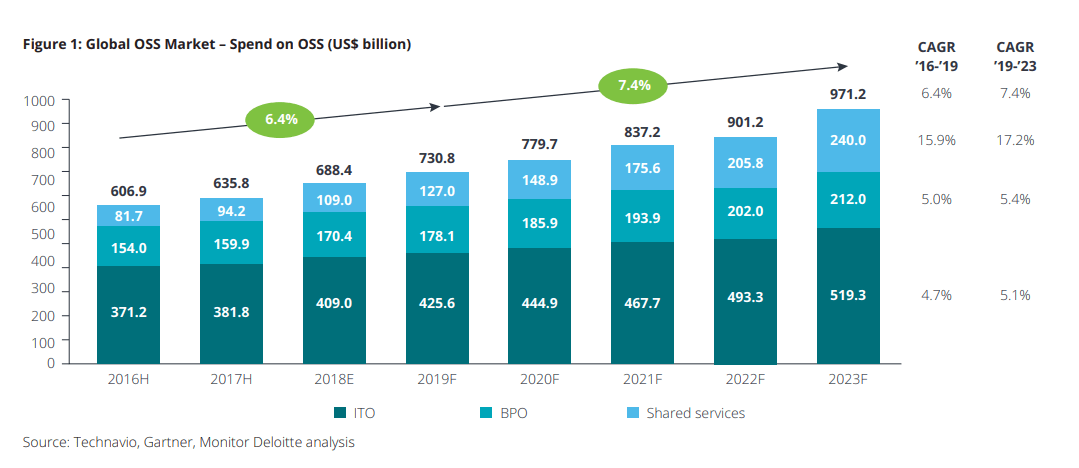

Being a basis of shared services, outsourcing allows companies to reach the required technology, skills, and expertise and scale it quickly. According to Deloitte’s Outsourcing and Shared Services 2019-2023 report, just last year, spending on OSS operations and services hit $688.4 billion.

Considering the unstable socio-economic situation in the world, outsourcing is becoming more and more in demand. This, combined with the constant need to introduce innovative technologies such as robotics and artificial intelligence to business processes to automate tasks and make business more agile.

Deloitte also predicts that the OSS market will grow at an over 7.4% compound annual growth rate (CAGR) from 2019 and reach US$ 971.2 billion by 2023. At this rate, the OSS industry will exceed US$ 1.0 trillion within the next 6 years.

Key drivers of outsourcing

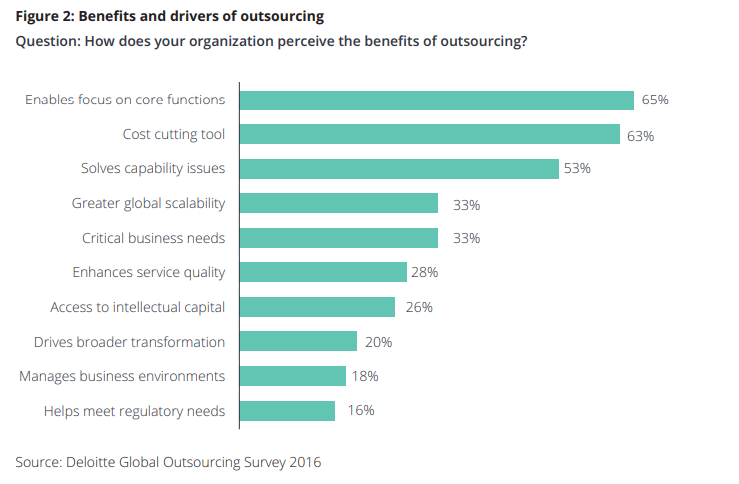

Key drivers of outsourcing on the global market is the ability of this approach to allow businesses to concentrate on core functions. This is a top reason why businesses outsource, according 65% of respondents Deloitte’s report. This followed by cost savings (63%) as outsourcing is a proven way to reduce cost on software development. According to statistics, partnering with offshore or nearshore software development companies can often reduce a company’s overall costs by 40% to 70%.

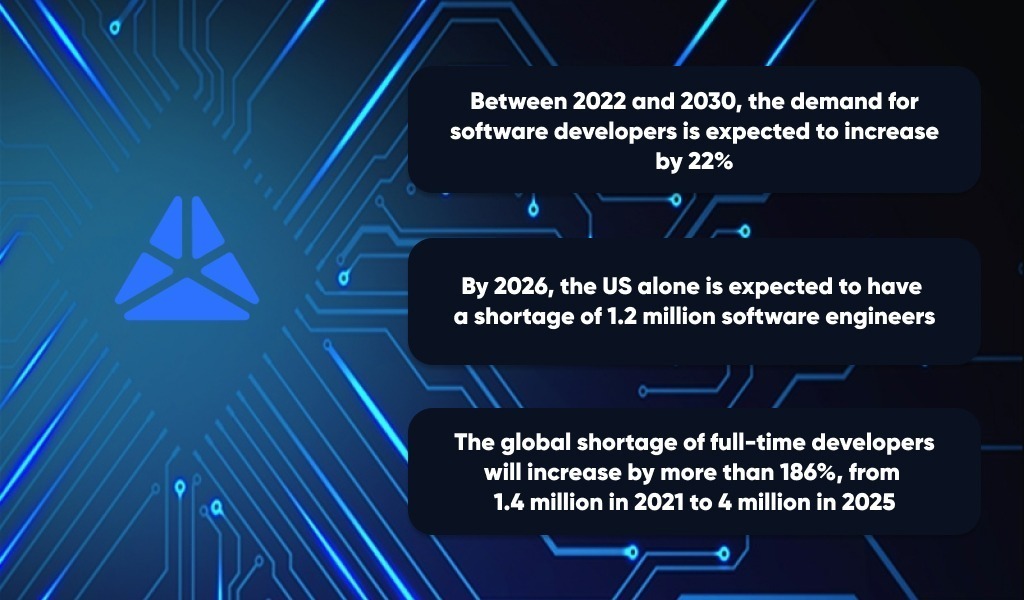

In addition, outsourcing helps businesses to get extra work capacities (the third most popular reason to outsource, according to 53% of respondents), and it also addresses massive talent shortages in the development market. According to Accelerance’s 2023 Global Software Outsourcing Trends and Rates Guide, between 2022 and 2030, an additional 22% increase in demand for software developers is expected. The global shortage of full-time developers will increase by more than 186%, from 1.4 million in 2021 to 4 million in 2025. By 2026, the US alone is expected to have a shortage of 1.2 million software engineers.

Talent Shortages in the Development Market | Accelerance 2023 Global Software Outsourcing Trends and Rates Guide

The global widespread remote work will also contribute to the further distribution of outsourcing. If earlier companies were shying away from hiring abroad, since the beginning of the pandemic they certainly found some benefit of team globalization which creates a more secure business foundation and possibilities of quick scaling (33%). The other benefits of outsourcing indicated are the ability to cover critical business needs (33%), enhance service quality (28%), get access to intellectual capital (26%), drive broader transformation (20%), manage business environments (18%), meet regular needs (16%). Considering the excruciating number of benefits, it is expected that next year interest in attracting talent developers from other countries will increase.

Is Eastern Europe Still the Best Destination to Outsource in 2023?

In 2022, Asia, LATAM, and Eastern Europe countries have once again proved their positions as top outsourcing destinations in the world. According to Statista, by the end of 2022, IT outsourcing revenue in Eastern Europe should reach $2.69 billion with a CAGR of 17.17%. By 2027 the volume of this market is expected to reach 5.94 billion dollars.

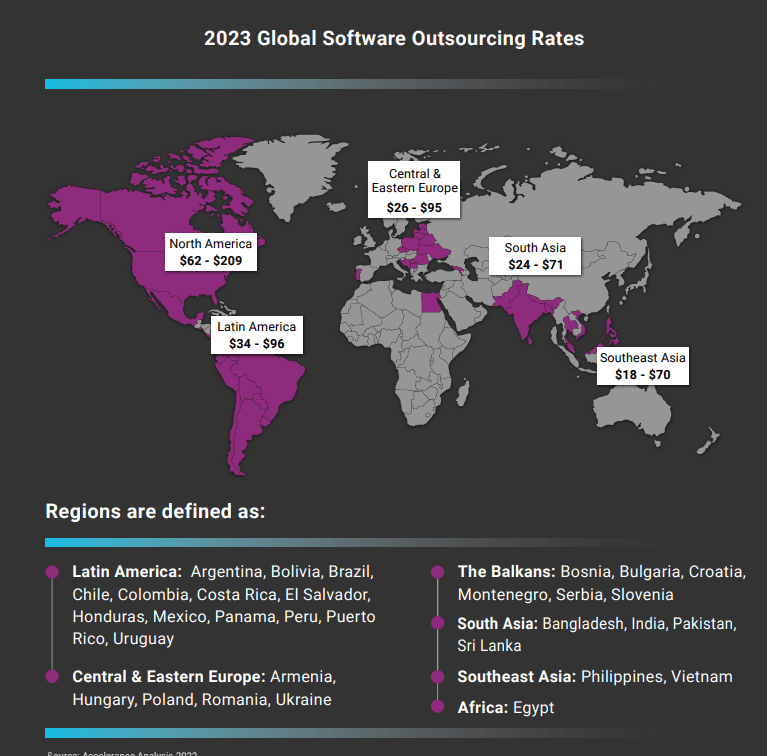

In 2023, the average rates in these countries are expected to be as follows: South Asia (24$-71$), North America (62% – 209$), LATAM (34$-96$), Southeast Asia (18$-70$), Central and Eastern Europe (26$-70$).

2023 Global Software Outsourcing Rates | Accelerance 2023 Global Software Outsourcing Trends and Rates Guide

Outsourcing leaders in Eastern Europe are Poland, Romania, and Ukraine. The latter even despite the war still firmly holds its position in the global outsourcing market. The main customers of Poland, Ukraine, and Romania are the USA, Great Britain, and Germany.

Due to the high quality of services and integration into the global community, these countries have become one of the best places for finding technical talent. Apple, Google, Amazon, and other leading enterprises from Fortune 500 companies have chosen these countries to open their development centers.

Overview of the IT Outsourcing in Poland

Poland is among the top countries in Eastern Europe for IT outsourcing. For a long time, Poland and Ukraine alternately took first place in the outsourcing world rankings. Both countries have a lot in common and it’s not limited to the affordable prices they offer.

What makes them best? Both Poland and Ukraine have:

- well-developed digital infrastructure

- digital-savvy professionals in their pool

However, if Ukraine is more focused on service export, Poland maintains a certain balance as the country actively develops both domestic IT companies and works for international corporations.

For many years, Poland has been among the leaders in the Digital Evolution Index. Poland was the third-most popular location for business and investment in the world in 2020.

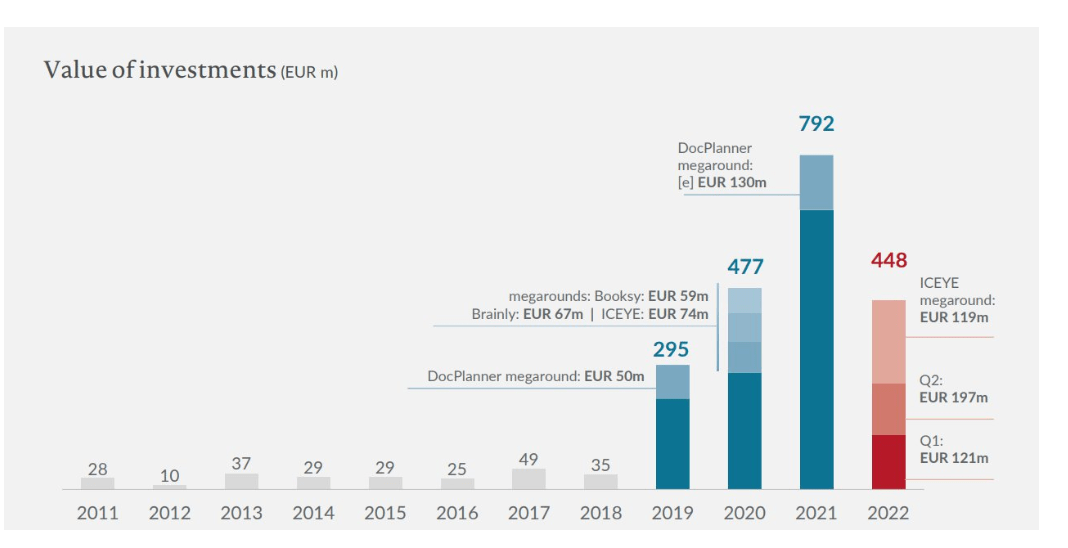

That’s why the startup ecosystem in Poland grows with lightning speed. The total amount invested in technology businesses in the first half of 2022 was already PLN 2076 million, or 76% more than in the same period of 2021, according to PFR Ventures.

Polish VC market in the second quarter of 2022 | PFR Ventures i Inovo Venture Partners Report

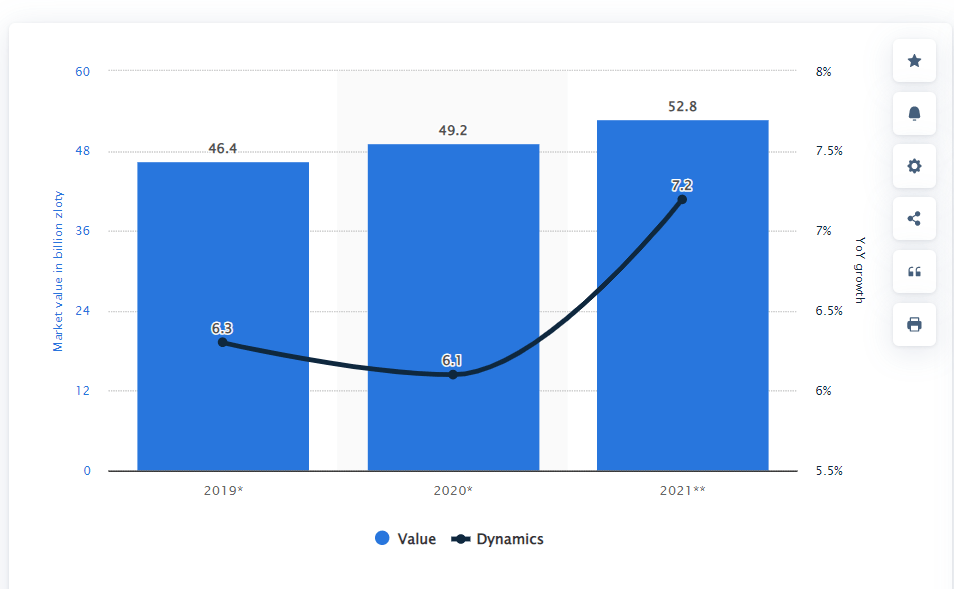

The value of the IT services market in Poland is about one-third of the total value of the domestic IT market. IT outsourcing in Poland is currently considered a very powerful and forward-thinking strategy on the global market. It has now surpassed the IT hardware industry in Poland. According to The State of IT Outsourcing In Poland Report, the expected value of the Polish IT market is $12.87 billion, up more than 7% from 2020.

2019 to 2021 Value and dynamics of IT market in Poland (in billion zloty)

ICT Education in Poland

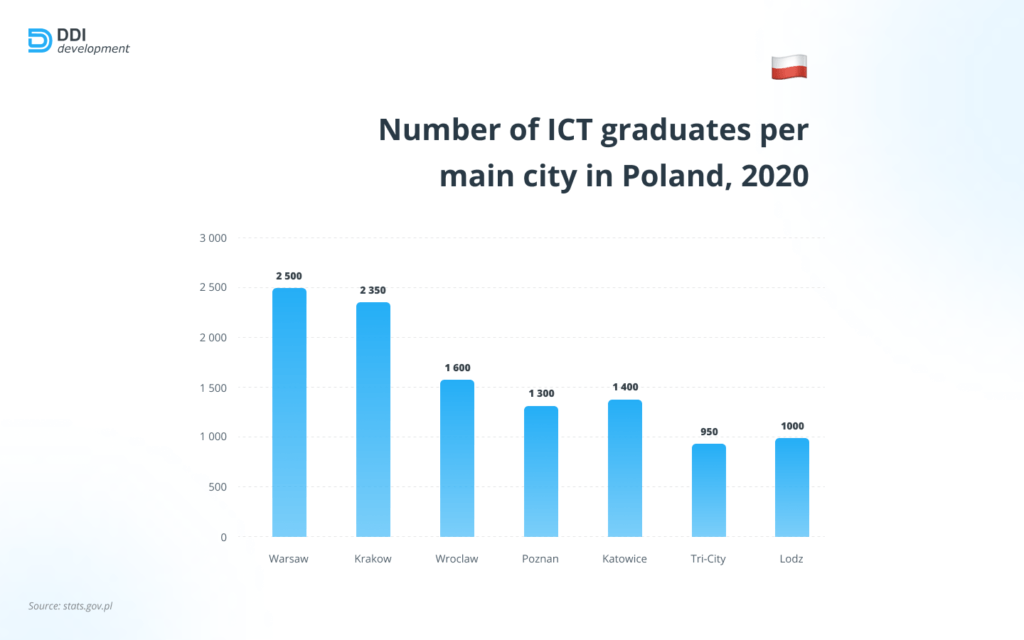

The most acknowledged education facilities in the country are the Krakow University of Technology, AGH University of Science and Technology, and Warsaw University of Technology. On average, 78,000 ICT students graduate from Poland’s tech universities each year.

ICT Education in Poland | Source: DDI development

High education in Poland revolves around science, engineering, and mathematics, providing robust knowledge to students. In the 2020/2021 academic year, 66,000 students were studying ICT in Poland.

Developer Population in Poland

According to Clutch, in 2022, Poland had around 900 outsourcing companies. The developer pool in this location consists of 250,000 specialists. The majority of developers in Poland are programmers (57%), and a large part is QA specialists (15%). Popular programming languages are SQL and JavaScript. It is also worth mentioning that Poland consistently ranks as one of the top three countries with the world’s best programmers.

Senior developers with 10 years or more of experience who are still youthful enough to adapt to new projects and working conditions make up the majority of the Polish labor force.

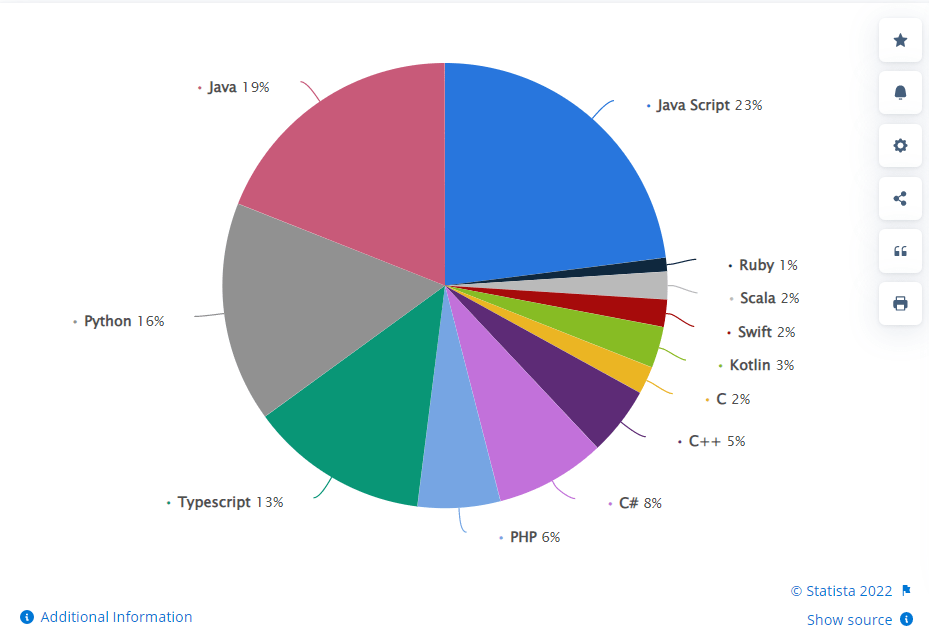

Regarding programming languages in Poland, the most popular, according to Statista, are Javascript (28%), Java (20%), Python (16%), TypeScript (8%), PHP (8%), and C# (7%), followed by Kotlin, Swift, Scala, and Ruby. Also, Poland can boast of a large contingent of PHP and. NET developers.

Poland’s most widely used programming languages | Statista

Developer Wages in Poland

The highest demand in Poland is for back-end specialists, and the number of vacancies for juniors in the field has also increased. According to Glassdoor, in 2022, the average salary of software developers is $13000 per year. Entry-level software developer salary is $7342 per year. Backend developers in Poland can earn around $12606 per year. Front-end specialists earn an average of $10233 per year, full-stack specialists can earn around $11990 per year.

Major IT Hubs In Poland

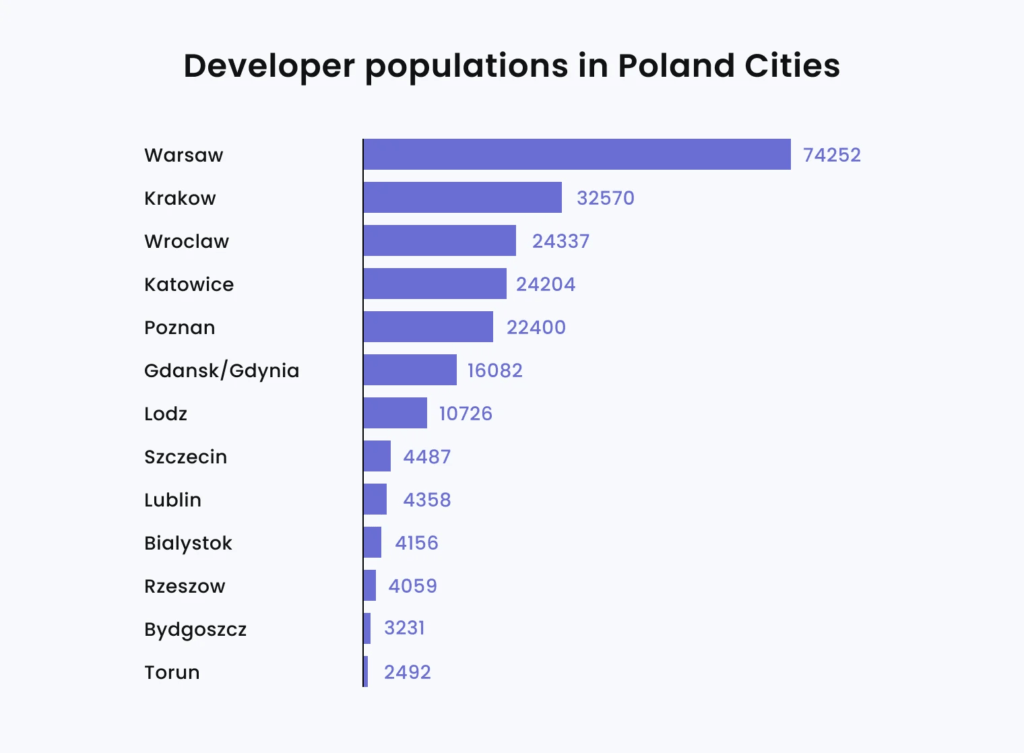

Poland has six major IT hubs that are redistributed along the country. The cities with the highest concentration of R&D professionals are Warsaw, Wroclaw, and Krakow. Warsaw, the capital and a huge educational center of Poland, has 11,600 workers alone in BPO centers. With more than 50,000 IT professionals, Krakow is the second-largest talent pool in Poland. Poznan, Katowice, and Lodz are better for small and medium companies in nearby countries or on the national market. Wrocław Otherwise referred to as the “Polish Silicon Valley”, belongs to the top 3 IT hubs of Poland and hosts around 12% or 51,500 development professionals.

Developer Population in Poland Cities | Source: Uvic

World Integration of Poland

Many customers also choose Poland because of their Western thinking and high integration into the European community. Proof of this is the high command of the English language among the Polish population. Poland ranks 11th in the world in terms of English language proficiency. In addition to excellent technical skills, more than 90% of local specialists are fluent in English. This paves the way for international specialists to join companies in Poland making them even more multinational and diverse.

In addition, the Polish IT sector has a clear focus on international projects. For example, a third of all Polish exports of IT services go to the USA. Out of half a million IT specialists, 34% work in companies with Polish capital, the 66% in foreign organizations. These figures should not be surprising given the high profitability of foreign investments. According to Ideamotive Report, every dollar invested in Poland by American companies creates 50% more value than other foreign investments.

An equally important factor is Poland’s membership in the European Union, which provides Polish IT companies with access to European investment funds that cover up to 85% of government spending on the industry. In addition, Polish companies also adhere to all necessary quality standards for product development and pay great attention to security. By the way, the financing of the IT industry in Poland is almost 2% of the GDP.

The Synergy of Polish and Ukrainian IT Market in 2023

2022 was the year when the global IT market changed under the influence of various political processes including the war in Ukraine. In fact, a really small percentage of customers in Ukrainian IT companies have left this country. At that time Ukraine already had a developed digital infrastructure for an established network of safe remote teams. So in March, when the war started, there was practically no decline in the Ukrainian IT market. However, many Ukrainian specialists were forced to leave the country, often changing their jobs due to various life circumstances. Many of them joined global companies, where the demand for Ukrainian specialists is quite high.

Curious about how Ukraine keeps coding in wartime? All the best practices can be found here.

The same goes for Poland which continues to receive a massive influx of workforce, including qualified IT specialists. Most Polish IT companies are ready to hire Ukrainian specialists. Having in their staff Ukrainians who are not only experienced but also flexible and mobile in terms of hiring, Polish companies get a serious competitive advantage.

A large number of Ukrainian companies and startups have also opened offices in Poland to provide additional guarantees of the security of clients’ investments. According to a survey from DOU, 35.2% of respondents moved to Poland from Ukraine after February 24, 2022.

Summing up: IT Outsourcing in Poland in Facts and Numbers

- The expected value of the Polish IT market is $12.87 billion, up more than 7% from 2020. (Ideamotive)

- Poland had around 900 outsourcing companies. (Clutch)

- The developer pool in this location consists of 250,000 specialists. (Ideamotive)

- Poland is one of the top three countries with the world’s best programmers. (DistantJob)

- The majority of the Polish labor force includes senior developers with 10+ years of experience. (DDI development)

- The average salary of software developers is $13000 per year (Glassdoor)

- Warsaw is the capital and a huge educational center of Poland, which has 11,600 workers alone in BPO centers. (Scand)

- The most popular programming languages in Poland are Javascript (28%), Java (20%), Python (16%), TypeScript (8%), PHP (8%), and C# (7%), followed by Kotlin, Swift, Scala, and Ruby. (Statista)

- Poland ranks 11th in the world in terms of English language proficiency (Notes from Poland)

- Every dollar invested in Poland by American companies creates 50% more value than other foreign investments. (Ideamotive)

How to Hire Developers in Poland

Now you see that Poland is an IT destination for outsourcing in Europe. However, like any other, recruiting in this region has its own characteristics and requires knowledge of the market. In addition, should the company match your budget, goals, and needs?

- Ideally, the agency has experience in international recruitment and hiring legislation.

- Choose agencies that have good feedback on Clutch on other resources, because this means that they value their reputation in the market and their main ambition is to find a candidate who will perfectly complement the customer’s team.

- At the beginning of cooperation with the customer, do not hesitate to ask as many questions as you consider necessary, familiarize yourself with the customer’s portfolio, hiring models, the culture of this company, and the approach and methodology to the selection of employees.

Hire Seasoned Software Developers Globally with MWDN

With 20 years on the market, MWDN has developed broad expertise in international hiring in the best countries for hiring tech talents (USA, Canada, Israel, Poland, and Ukraine). Our approach is based on hiring the best-fit candidates to complement the team of our customers, and the high retention rate (87%) on our project is proof of that. Formulating the team, however, we prioritize quality over quantity to ensure that your success story becomes a part of our book of impeccable business reputation. MWDN sets up:

- dedicated teams

- individual professionals to supplement your team (team extension)

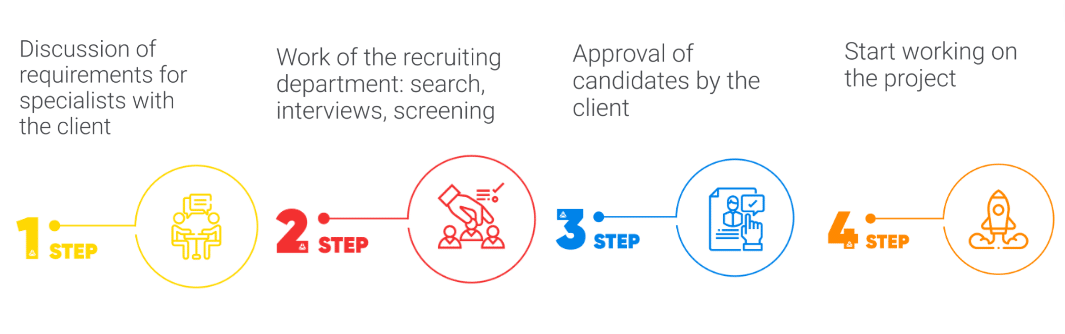

The recruiting process with MWDN includes:

Contact us – get the best software development professionals in the top outsourcing location with MWDN.

Content

- 1 Global IT Outsourcing Market On the Cusp of 2023

- 2 Is Eastern Europe Still the Best Destination to Outsource in 2023?

- 3 Overview of the IT Outsourcing in Poland

- 4 The Synergy of Polish and Ukrainian IT Market in 2023

- 5 Summing up: IT Outsourcing in Poland in Facts and Numbers

- 6 How to Hire Developers in Poland

- 7 Hire Seasoned Software Developers Globally with MWDN